The inland navigation congestion problem in Antwerp and Rotterdam is not new, the only thing that has changed is the length of the delays. The problem is also not solved because all stakeholders – with the exception of the Port Authority – have no intention of committing to fundamental and structural solutions. The Municipal Port Authority has fulfilled its role as Public Authority to the maximum. BTS, Consolidation Hubs with subsidies and bringing parties around the table have been successful to a certain extent. It plays its role as facilitator but can do little else, although…. As far as the other stakeholders – read shipping companies and terminals – are concerned, it is a different story. To quote one of the inland navigation ship owners involved: “They don’t give a fu…”.

The expertise office SEASC4U delivered a study in April 2014 in which facts and figures were presented, conclusions and recommendations were made. The study was delivered to the CEOs of the Terminals MPET, DP World, PSA, APM Terminals, ECT and the Rotterdam and Antwerp Port Authorities, the shipowners CMA-CGM, Maersk and MSC and for the inland shipping sector to ICBO. She was Pro-Bono.

Nothing, I repeat, nothing of the conclusions and recommendations was withheld.

The Municipal Port Authority

8/10. With the 5 action points the Port Authority has facilitated solutions within its powers and possibilities. Nevertheless, BTS, among other things, must be able to do better, but the commitment of the stakeholders is low. What can the Port Authority enforce? Digitising and NxtPort’s commitment is promising, but again it depends on the stakeholders. Bundling via consolidation hubs has been introduced but the question is whether it will be sufficient and whether it will continue when the subsidies disappear. CEPA has finally woken up after the debacles of recent years – especially during the summer months – and is working hard on the dock workers quota. July and August are the litmus test. Construction of Dedicated Berths ?????? I’ll get back to it at The Terminals.

ICBO

?? Very active (sic.) My apologies to the well-meaning directors, but if the last “newsletter” is dated 25 November 2017, we can’t really speak of “playing short on the ball”. If we go over the membership file, I’ll refer you to De Barge Operatoren. If the members – perhaps with a few exceptions – are neither interested nor interested in improving the situation, another zillion declarations of intent can be officially signed and published, but then it remains dead letter.

The Barge Operators

The inland navigation sector is still one of the most fragmented in Europe. If we take a look at the members of ICBO – which is quite representative – we see that almost all of these operators are also Inland Terminal operators. This gives them a firm grip on the intermodal chain. It is not the congestion in the ports that is their problem – they recover it by means of a congestion surcharge on the goods. For them, the real problem is the modal shift that causes the congestion and the effect on the load factor of the ships. Many goods can’t wait 3 days with the risk of missing the connection to the seagoing vessel. With imports it is a little less sensitive but the goods will still choose to transport their containers by road. The Barge Operators shift the soot to the Terminals.

The Shipowners

It’s not their problem. (sic.) They’ve dumped a significant number of their 20,000 TEUs and then leave it on the land side to pursue their plan. They don’t like working together or consolidating because “the competition today is more on land than at sea”. Proposals to jointly develop an EBS (European Barge Shuttle – copy / paste ERS – European Rail Shuttle) concept and take control over the E2E chain is also not interesting – too many resources and too little return. Shipowners turn their backs on this fact and refuse to take responsibility. So much for their commitment to a sustainable transport chain.

The Terminals

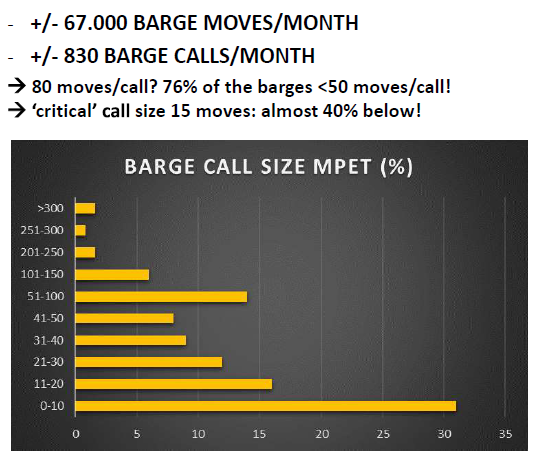

Not much has changed since 2014. Let other stakeholders take the hot bricks out of the fire. The consolidation hubs meet the sub-optimal use of resources at the terminals and reduce the number of calls, which improves quay occupancy. This means a profit for the Terminals. On the basis of figures, it became clear that one particular terminal needed 3 permanent quayside capacity totalling 400 metres, exclusively dedicated to inland navigation. At other terminals the need for dedicated barge quay capacity was comparable. Almost nothing has changed since 2014 and investments in sufficient adapted quay capacity are zero.

The same study refers to the EBS (European Barge Shuttle) concept. The Terminals are “The Spider in the Web” and are in the best position to take E2E control over the containers they handle. By linking the container from on-board stowage to a stacking point at an inland terminal, they can optimise their operations in both seaports and inland ports through their own process control. Not only do they have to invest in inland facilities, but they also have to be prepared to set aside their local seaport egos and seek cooperation. EBS is a purchasing process and does not interfere with the sales process in which the individual terminals remain commercially independent, but through cooperation they expand their margins without penalising the customers/users. It also enables them to be less dependent on market monopolizing inland waterway operators.

Conclusion

I repeat the conclusions shared with all stakeholders in April 2014:

“Only if we keep an open mind and focus on the really important objectives of developing our multimodal and logistics activities in a sustainable way with empathy for future generations, will we be able to keep the engine oiled and moving. The transport target of 45% per Barge by 2035 is a less than ambitious target – we can and must do better and achieve it much sooner. The transport of goods by inland waterways is a key factor for the possible solutions, seeing that the current infrastructure of canals and rivers, on the one hand, and the carrying capacity of inland vessels, on the other hand, offer every opportunity to achieve the objectives of current and future sustainable logistics solutions. A 4P platform that balances People, Profit. Partnerships and Planet forms a solid basis for such developments. This study makes a modest contribution”.

They still haven’t understood.